Hungarian firm B+N Referencia Zrt. ranks 8th globally in The Biggest Fleet 2025, underscoring the rising importance of Central and Eastern Europe in cleaning robotics.

The second edition of The Biggest Fleet shows cleaning robotics rapidly moving from experimentation to industrial scale. The ranking has more than doubled, growing from 42 to 97 fleets in a year as operators shift from pilots to widespread deployments and global benchmarking.

Backed by a broader research effort combining open applications with independent verification, the 2025 dataset offers the most comprehensive snapshot yet of how cleaning robots are being deployed across sectors and regions.

The data shows a market growing in both speed and scope. Retail remains the dominant driver of adoption, while hospitality and public institutions are emerging as important secondary engines of growth. At the same time, expansion remains uneven: more than half of all fleets still operate at a relatively small scale, equivalent to ten or fewer scrubber robots.

Consequently, the market is widening faster than it is deepening, with many new entrants but only a limited number of significant rollouts.

Robots, Microbots, and Two Parallel Paths

Fleet strategies continue to diverge. Nearly two-thirds of operators rely exclusively on large cleaning robots, while around one-fifth run only microbots. Mixed fleets remain a minority and are concentrated among professional cleaning service providers, reinforcing their role as robotics specialists adapting to varied customer environments.

Geographically, the United States continues to consolidate its position as a global hub for cleaning robotics, while Asia shows broad-based momentum. In Europe, the centre of gravity is shifting east, with Central and Eastern European operators gaining visibility. This rise contrasts with the relatively limited presence of Southern European operators at a similar scale.

The German-speaking DACH region follows a different trajectory, with several facility managers deploying microbots in large numbers as part of established operating models rather than as pilot programs.

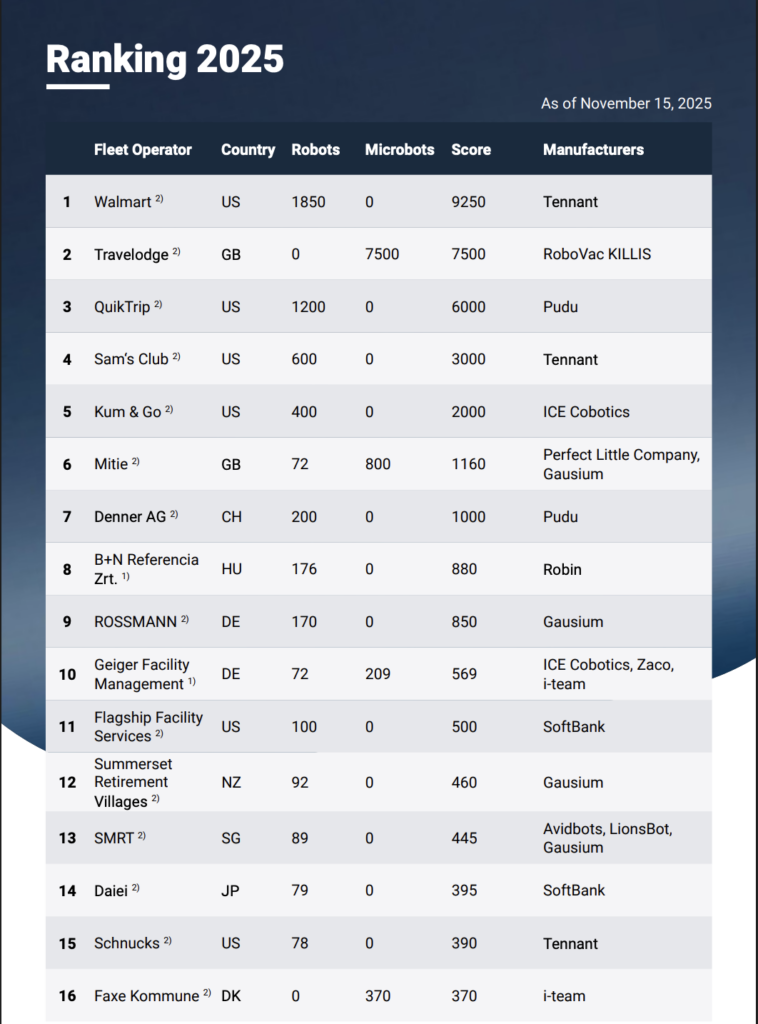

At the top of the 2025 ranking, scale is driven by retail and service networks. Walmart leads by a wide margin with 1,850 cleaning robots supplied by Tennant. The UK’s Travelodge ranks second, operating 7,500 microbots across its hotel portfolio, while U.S. convenience retailer QuikTrip takes third place with 1,200 robots from Pudu.

B+N Referencia and the Rise of In-House Robotics

One of the most notable European entries comes from Hungary, the report points out. Facility management company B+N Referencia Zrt. ranks 8th globally with 176 units of its proprietary robot, Robin. Developed in-house and deployed in hospitals and airports across Central Europe, the fleet illustrates a growing trend of FM companies evolving into robot developers themselves.

A Fragmented but Maturing Market

The 2025 ranking also highlights a fragmented supplier landscape. From global equipment manufacturers to specialised start-ups, no single vendor dominates across sectors or regions. Taken together, the findings underscore a market that is no longer emerging, but rapidly scaling—along multiple paths shaped by local conditions, technology choices, and operational models.

radar.fieldbots.com